Overhauling the USD 8 trillion lending market infrastructure with New World China Land Limited

Background and introduction

The global loan market size reached USD 7.9 trillion in 2022 and is expected to grow at CAGR of 13% to reach about USD 30 trillion by the end of 2030. To date, there has been a larger focus on digitalisation and tokenization of bonds versus loans, despite many operational challenges in the latter. Marketnode, leveraging upon its experience in bond market digitisation, sees opportunities to help advance the loan industry towards a more digital state.

At Marketnode, we understand need for a long-term perspective when building financial market infrastructure. Over 2022 to 2023, we have sought to understand the borrowers and lenders pain points in greater detail. In working with the ecosystem and observing the industries current processes, we identified the following challenges:

Accurate registry of loans, holders’ information, and transactions

Accurate and timely Environmental, Social, and Governance (ESG) and sustainability-linked loan (SLL) information and financial reporting

Tracking outstanding deals at issuer, agent or lender level

Automation of settlement, transfer timings and associated processes

These challenges must be addressed to build a solid foundation for loan tokenisation at scale.

Validated pain points

Our industry discussions unveiled a plethora of inefficiencies such as manual processing, high costs, limited transaction visibility and payment delays within loan markets today. Legacy banking payment networks continue to cause delays anywhere from 24 hours to 5 business days, leading to costly agent bank processing. Low-tech and siloed ‘record-keeping processes (e.g., via Microsoft Excel) lead to inconsistent data across the participant chain, which includes lenders, borrowers, agents and other intermediaries.

Secondary transfers, voting activities and ESG / SLL / financial reporting were other time-consuming activities. Some participants noted that the secondary transfer process took up to 30 days whereas in the bond market it is typically 2 days.

The recurring sentiment of digitisation before digitalisation once again rang true. As APAC’s distributed ledger technology (DLT) powered FMI, DLT’s application as a uniform record keeper was clearly applicable to lending markets and provided a pragmatic bottom-up approach to tokenisation.

The case study below illustrates the improved workflows via Marketnode Gateway. Throughout the process, we worked with New World China Land Limited, its agents and banking partners to design and build a true industry-led solution.

Current process

ESG / SLL frameworks and other financial information and reporting takes many hours to disseminate to lenders and stakeholders. Lenders would like to receive and see such data in a structured format such as framework details, eligible project categories and allocation / impact data.

Lenders have few options for a 360-degree portfolio view of their borrowers and its asset lifecycle during the duration of the loan including aggregate information for analysis. There is limited transaction visibility between parties which can lead to, payment delays or mistakes. All inefficiencies lead to greater implicit costs across the ecosystem.

Illustration of borrowers / agents using legacy, low tech tools to record holder information, keep up-to-date on interest payments and corporate actions

Improved workflow via Marketnode Gateway

Marketnode Gateway’s loan offering leverages on our existing bond technology capabilities including data, workflow, and documentation, utilising an ‘agile’ approach to building technology alongside the industry.

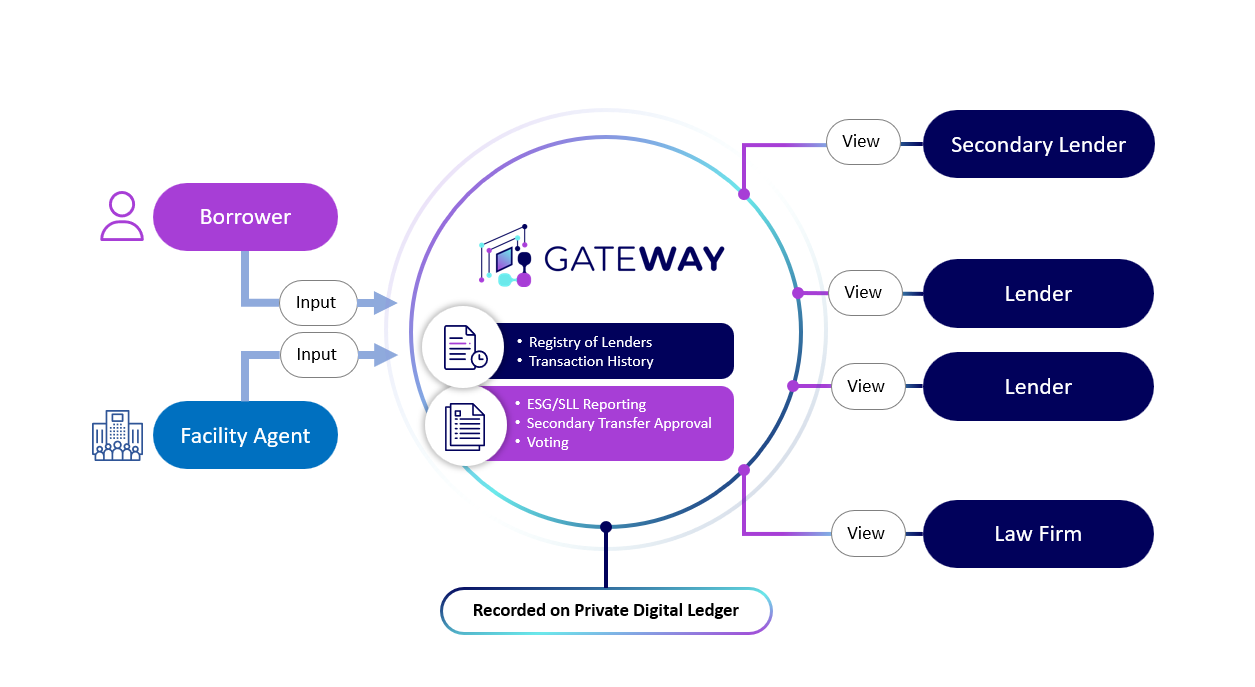

Within the platform, the borrower and facility agent can now input information for single-source record keeping and a more efficient way to communicate to lenders for reporting information such ESG / SLL reporting or ongoing financial reporting, amongst others. Other loan workflow items such as amendments and waivers, loan drawdowns and transfers can be completed and managed on the platform as well. In addition, we also offer the ability to manage KYC or other due diligences documents on platform.

Illustration of Marketnode Gateway’s flow

Here, tokenization as the base technology per se, but an improved technology stack allowing for a more comprehensive loans offering for the market:

Project management and user permission matrix allowing for per loan based access

Leveraging artificial intelligence (AI) in conjunction with our data extraction and structuring technologies, allowing for data aggregation and efficiencies in workflow

Business insights and data visualization for key breakdowns on the borrower’s portfolio

Structured management of payments and corporate action history

A private DLT-based digital ledger for record keeping and uniform source of truth across all deal participants

Workflow management tools such as communication dissemination, registry of holders, transaction history recording, structured management of payments and corporate action history

New World China Land Limited has used our platform to record multiple loans and we are working with a pipeline of Asia based borrowers. Lender management, recurring task management and information dissemination were key features co-developed with the borrower and agents. As we onboard further parties onto the platform, we will continue to leverage upon their feedback to build a true industry-led infrastructure for Asia’s loan markets.

Benefits and results

Secure issuer / agent permissioned access for data privacy

Real-time information and updates circulated for lender data consumption

Centralized portfolio management of lenders and transactions

Improved ESG profiling for issuer

Single platform 360-degree portfolio view

Last but not least, we would like to show our sincere appreciation for New World China Land Limited, a major property, infrastructure and development company that has been an anchor development partner since 2022, giving us valuable design input in our platform build-out. The Marketnode Gateway Platform has been used to manage five of New World China Land Limited’s loans, including sustainability-linked loans totalling to HKD 4 billion.

Sample screenshot of borrower and agent data management interface

Sample screenshot of lender and law firms interface

Screenshot of NWCL GSSS Framework

Looking ahead

The current state of lending markets lends itself to an evolutionary versus a revolutionary approach. Even if we succeed in asset digitalization, larger scale cash digitalization is needed, although recent initiatives such as HSBC’s blockchain based corporate payments platform is a good beginning.

Whilst we remain focused on bringing a greater network of issuers, law firms and lenders onto the platform, we are working on some key market-wide initiatives on secondary loan transfers and accompanying market infrastructure that will come to light over 2024.

Reach out to us to find out more and organise a demo: [email protected]

About Gateway

Gateway is a one-stop, end-to-end platform enabling market participants to accelerate workflows, lower time to market, and capitalise on the transformative potential of tokenisation. We have a wide database of 1,500+ borrowers, lenders, agents and law firms and are constantly expanding users and intermediary coverage on the platform.

About New World China Land Limited

New World China is the flagship Mainland China property arm of Hong Kong-listed New World development company Limited (“NWD”; Hong Kong Stock Code: 00017) and an early Hong Kong Pioneer entering the Mainland China property market. Our vision is embodied by a humanistic spirit inspiring us to create fulfilling places and thriving cities that people love to call home. Guided by insight, we are inject innovation into large-scale mixed-use commercial landmarks, offices, shopping centres, residential; neighbourhoods that allow people, city and nature to flourish in harmony. We bring the “Soul of the City” to life.

For more information: https://www.nwcl.com.cn/en